Portfolios

The Freedom Advisors platform supports the following types of portfolios, all of which are considered subaccounts:

- UMA Models

- Unaffiliated Cash

- Discretionary (non-program holdings such as a concentrated stock position)

Models

A model is a single-sleeve portfolio. The portfolio can have in it an unlimited number of securities, but only one model sub-account or sleeve. For example, a model might consist of 15 exchange traded funds.

We attempt to maintain a 1.50% cash buffer in the model by default and over time that will dwindle by fees and be replenished by dividends, deposits, rebalances, or sells.

When a distribution is initiated at the custodian, cash will be pulled from the account’s portfolios in the following order: Unaffiliated Cash -> Discretionary -> Model. For this reason, we recommend advisors request the distribution amount in their ‘Raise Cash’ service request; if there is already Unaffiliated Cash in the account, then the appropriate ‘Raise Cash’ amount would be the difference between the distribution and Unaffiliated Cash amounts.

UMA Models

A UMA model is a multi-sleeve portfolio. In each sleeve is a standalone model and multiple models are combined together in the UMA model.

Unaffiliated Cash

Cash in an Unaffiliated Cash portfolio can typically be thought of as incoming or outgoing funds, although an investor may hold cash reserves in the Unaffiliated Cash portfolio. Cash deposited into an account will be placed in the Unaffiliated Cash portfolio by default. Any cash that is generated through a service request (Systematic Withdrawal/Raise Cash/Terminate/Liquidate) will be journaled to the Unaffiliated Cash portfolio after trades have settled.

If an account is not set on Auto Invest by the advisor, Freedom will not invest Unaffiliated Cash into a model unless instructed to do so through a service request. Advisors may request cash be invested into a model using the Inject Cash, New Investment, Dollar Cost Averaging, or Change Managed Investment service requests.

Discretionary (non-model holdings)

Discretionary portfolios hold securities that are not associated with a model, either newly deposited securities or securities which Freedom should not trade. Freedom will not trade securities within a Discretionary portfolio unless explicitly instructed to do so via a New Investment, Change Managed Investment, or Inject Cash service request.

If a sell is placed by an advisor within the Discretionary portfolio, the cash proceeds will remain in Discretionary and will not be moved into Unaffiliated Cash unless specifically requested by the advisor.

Service Center

The Service Center is the platform’s internal ticket management service where advisors can submit trade requests, trade holds, cash monitoring requests, open new accounts, and transfer in outside accounts. It is the preferable method of communication for single trade requests. Service Requests are organized into five categories on the platform:

- Investment Management

- One-Time Service

- Ongoing Service

- Holds & Alerts

- End Service

Before submitting a service request, please make sure to review the service history and all ongoing Service Requests within a household to avoid potential conflicting or duplicate instructions. Examples of conflicting service requests include:

- An Auto Invest and a Systematic Withdrawal

- An Inject Cash immediately following a Raise Cash

- A Dollar Cost Averaging request and a Systematic Withdrawal

If the ‘Notifications’ box is selected within a service request, the submitter of the request will receive email updates on the status of the request.

Investment Management

New Investment

The New Investment service request is used to provide instructions to invest an account into one or more new models not currently held in the account. If an account is already invested in a model and you wish to add more funds to the model, then you should submit an Inject Cash service request.

It is important to review the Unaffiliated Cash portfolio and the Discretionary portfolio within the account prior to entering the ‘Investment Amount’ for a service request. The Investment Amount should reflect the account value less any cash or securities that will remain outside of the investment(s) selected in the service request.

The ‘add new row’ option under ‘Product’ will allow for the addition of multiple models within one account.

If there are any specific instructions related to individual securities or cash to leave outside of the model, this can be relayed in the ‘Notes’ section of the service request.

It is always helpful to enter a Note confirming the intentions of the service request. If a member of the trading team is not clear on the intention of the service request, no action will be taken and the advisor will receive a message requesting clarification.

Change Managed Investment

The Change Managed Investment service request is used to make changes to an account that is currently invested in a model by:

- Swapping one model for another model

- Adding a model

- Reallocating funds across existing models

- Combinations of 1, 2, and 3.

If there are any specific instructions related to individual securities or cash to leave outside of the model(s), this can be relayed in the ‘Notes’ section of the service request.

It is always helpful to enter a Note confirming the intentions of the service request. If a member of the trading team is not clear on the intention of the service request, no action will be taken and the advisor will receive a message requesting clarification.

One-Time Service

Inject Cash*

The Inject Cash service request is used to invest cash into a model in which an account is already invested.

When submitting an Inject Cash service request, please make sure to review the Service Center to confirm if there are any active Systematic Withdrawal plans or cash raised via a ‘Raise Cash’ service request prior to submitting the ‘Inject Cash’ request as funds may be sitting in Unaffiliated Cash for withdrawal.

The Inject Cash service request is not needed if there is an active Auto Invest established on a portfolio.

Raise Cash*

The Raise Cash service request is used to generate cash only one-time within one portfolio.

Options:

- Raise Cash (Recommended) will take into account the cash position within a portfolio and raise cash accordingly. If cash in the portfolio is low, excess cash will be raised to bring the cash back to the target allocation. If cash is high, less cash may be raised but the total amount entered in the request will be moved to Unaffiliated Cash.

- Generate Sells ignores the current cash position in the portfolio and sells securities to raise the requested amount of cash

Regardless of which Option is selected, the amount entered in the service request will be moved to Unaffiliated Cash. If the client wishes to transfer the cash out of Freedom, separate instructions must be provided at the custodian. Accordingly, we recommend putting the actual distribution amount for sale of additional securities in the service request.

*With each 1-time service request, the Trading Team will calculate trades so that the product is as close to being in balance with the model target weights as possible.

Ongoing Service

Systematic Withdrawal

The Systematic Withdrawal service request is used to automatically raise a specific amount of cash within a portfolio at a set frequency. Once the service request has been submitted, the Systematic Withdrawal will reflect in the Service Center queue as a ‘recurring ticket’ as well as an ‘instance’ ticket. The recurring service requests that raise cash based on the entered instructions will reflect on the platform as a ‘Systematic Withdrawal Instance.’ Note that this instruction does not actually result in the withdrawal of cash from the account. The result is the requested cash is deposited in Unaffiliated Cash in anticipation of a coming account withdrawal submitted at the custodian.

The frequency and date entered into the request reflects the trade date opposed to the distribution date at the custodian. It is recommended to enter the trade date 7 days before the distribution date to account for non-trading days to ensure cash is available on the distribution date.

In the Frequency dropdown, ‘Quarterly’ is not an option but this can be achieved by selecting Monthly, every 3 months.

The Start Date should be at least one day prior to the first desired trade date. The Start Date refers to when the Systematic Withdrawal is active in the account, not necessarily when the first instance will be generated.

To make changes to an existing Systematic Withdrawal, navigate to the reoccurring ticket on the Trading Service Center and hit the ‘Modify’ option to change the Raise Cash Amount or the frequency. To stop the request, the ‘Cancel’ option should be used. If you need to make changes to the service request on the trade date, please contact Advisor Services by phone or email for assistance as trades may already be in process.

Auto Invest

The Auto Invest service request will automatically invest cash held in Unaffiliated Cash into an individual portfolio or multiple portfolios. Once submitted, the Auto Invest will reflect in the Service Center queue as a ‘Recurring Auto Invest.’ The ‘Auto Invest Instance’ service request will generate to initiate trading when cash is deposited that is greater than the minimum investment amount.

Multiple Auto Invest service requests for the same account are prohibited. To invest contributions in an account with multiple portfolios, modify the existing Auto Invest to include multiple portfolios, with the total allocation to all portfolios equaling 100%.

The Auto Invest service request cannot be established on an account that has a Systematic Withdrawal recurring service request in place or is set up for Dollar Cost Averaging.

Dollar Cost Averaging

The Dollar Cost Averaging service request is used to inject a specific amount of cash already in the account into an individual portfolio at a set frequency for a set number of instances.

Funds for Dollar Cost Averaging must be held in cash in the Unaffiliated Cash portfolio. If funds are held within a money market fund or mutual fund, the Dollar Cost Averaging service request should not be used. The advisor should sell the fund and then submit an Inject Cash service request whenever they wish to have funds invested and include a note that cash is held in Discretionary.

An account with a recurring service request for Dollar Cost Averaging cannot also have a request for Systematic Withdrawal.

Conflict Rules

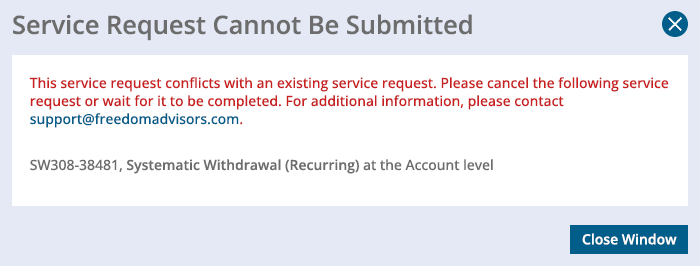

An account cannot have multiple service requests that conflict with each other. For example, having a Systematic Withdrawal and Auto-Invest in place at the same time is not allowed. These rules apply at the account level, not portfolio.

Note: Nearly all Service Center functions apply only to Model portfolios and not Discretionary portfolios. For example, a Systematic Withdrawal cannot be placed on a Discretionary portfolio. Trades can only be made from Discretionary if used as a funding source to inject proceeds into a model (e.g. via an Inject Cash service request). It gets complicated and risky thinking about t+2 and preventing Reg T violations if we were to allow Systematic Withdrawals, Dollar Cost Averaging or Auto-Invest in the same account but different portfolios. So conflict rules apply only at the account level. Below is the error a user can expect to see if they try to submit a service request that doesn’t pass the conflict rules test.

Holds & Alerts

Trade Hold

The Trade Hold service request will prevent trading from occurring. A Trade Hold may be requested at the Household, Client, Account, or individual Portfolio level. A service request submitted at the household level will have the trade hold applied to every account within that household. A portfolio level trade hold should only be used if the trade hold applies on only one portfolio within a multi-portfolio account. Otherwise, using the account level trade hold is best practice.

If you submit a Trade Hold after the market has opened, it is possible that there may be trades already in process from either service requests or model allocation changes. If it is important that no conflicting trades take place, please call and/or email support@freedomadvisors.com to confirm if there are any pending trades in the account. In some cases, trades may not be able to be stopped as the block may already have been submitted to the custodian.

To remove a Trade Hold, select the ‘cancel’ option within the original Trade Hold service request.

Whenever Freedom receives a notification from the custodian regarding a new restriction on an account, we will place the account on Trade Hold in the Freedom Platform if the restriction prevents trading. Example restrictions that prevent trading:

- Address Restriction

- Deceased Account Holder

- Outgoing ACAT

Cash Monitoring

The Cash Monitoring service request establishes alerts related to an account’s cash levels, inflows, and outflows. To set up alerts on multiple accounts, multiple Cash Monitoring service requests must be submitted. Alerts are determined based on an account’s upper and lower cash thresholds, as well as the start and end dates specified in the service request.

Cash Monitoring alerts may be viewed in the Cash Monitoring module in the advisor dashboard, in a Reporting Center Cash Monitoring report, and via email if the checkbox for notifications is enabled.

End Service

Terminate/Liquidate

The Terminate/Liquidate service request is used to:

- Liquidate a portfolio completely, in which case proceeds will be moved to Unaffiliated Cash

- Liquidate specifically requested securities within a portfolio and cease management*

- Cease management* with no liquidation trades

*Remaining positions will be moved to a Discretionary portfolio

If multiple portfolios exist within an account, a Terminate/Liquidate service request should be submitted for each portfolio within the account.

Depending on the option selected within the service request, cash will be moved into the Unaffiliated Cash portfolio and securities will be moved into the Discretionary portfolio.

Information as of January 2022. The information contained herein reflects our current policies, processes, and procedures as of the time of publication. These are subject to change at Freedom’s discretion.